Renters Insurance in and around Grand Forks

Your renters insurance search is over, Grand Forks

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Grand Forks

- Thompson

- Grafton

- Crookston

- Hillsburro

- Mayville

- Fargo

- East Grand Forks

- Larimore

- Northwood

- Valley City

Calling All Grand Forks Renters!

There are plenty of choices for renters insurance in Grand Forks. Sorting through savings options and coverage options to pick the right one is a lot to deal with. But if you want economical renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy unmatched value and straightforward service by working with State Farm Agent Logan Karsky. That’s because Logan Karsky can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including videogame systems, clothing, furnishings, furniture, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Logan Karsky can be there to help whenever trouble knocks on your door, to get you back in your routine. State Farm provides you with insurance protection and is here to help!

Your renters insurance search is over, Grand Forks

Rent wisely with insurance from State Farm

Agent Logan Karsky, At Your Service

Renters insurance may seem like last on your list of priorities, and you're wondering if it can actually help protect your belongings. But imagine the cost of replacing all the possessions in your rented townhome. State Farm's Renters insurance can help when abrupt water damage from a ruptured pipe damage your valuables.

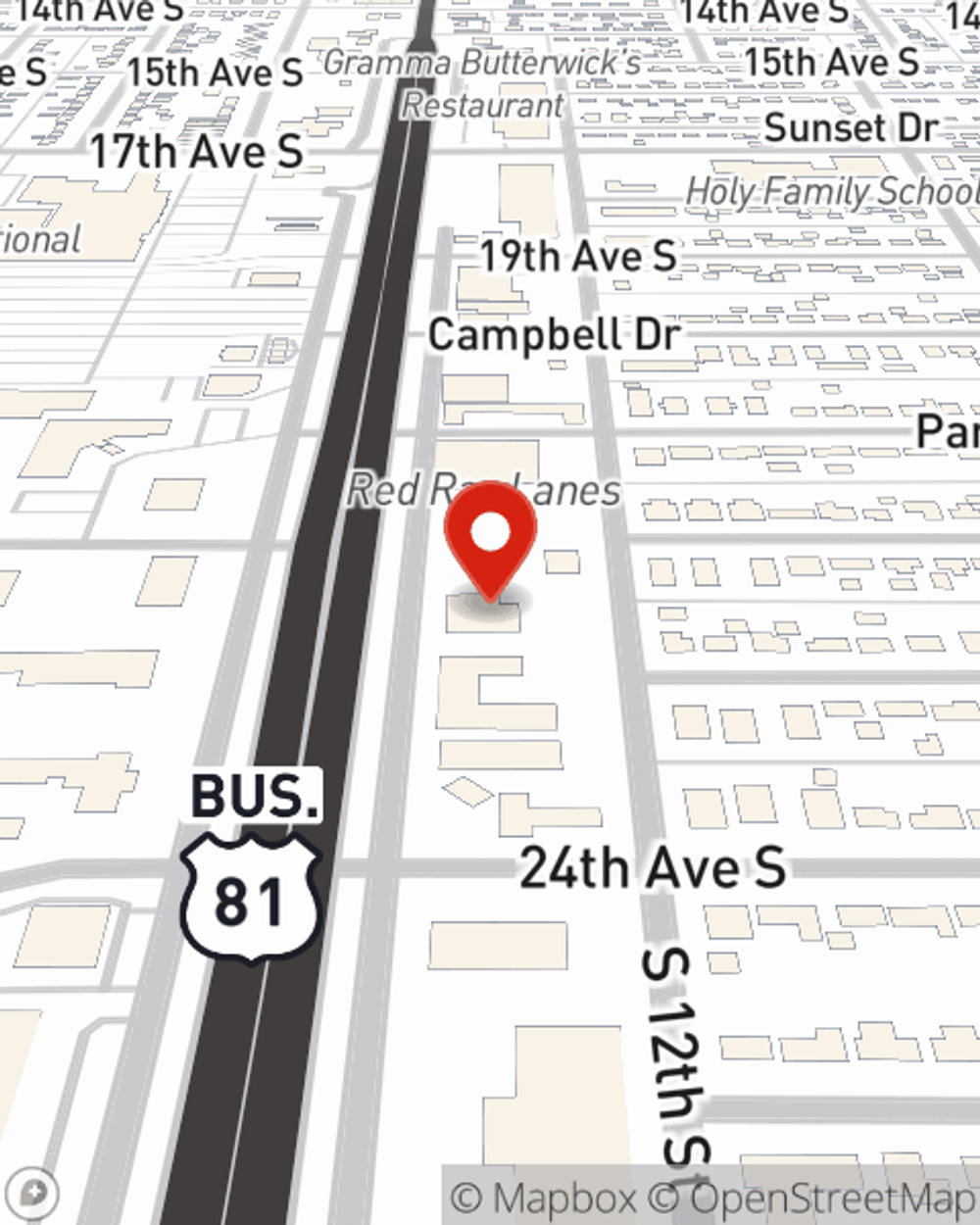

As a value-driven provider of renters insurance in Grand Forks, ND, State Farm strives to keep your life on track. Call State Farm agent Logan Karsky today and see how you can save.

Have More Questions About Renters Insurance?

Call Logan at (701) 203-0210 or visit our FAQ page.

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Logan Karsky

State Farm® Insurance AgentSimple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.